Amazon Vendor P&L Management: Automated

Vendor Central makes traditional P&L management a time-consuming challenge. Instead of a dedicated finance report or data feed, Amazon hands brands a number of accounting data challenges:

- Data fragmentation: Finance teams draw data from PO, invoice, coop, remittance, advertising, and other interfaces just to get started

- Timing complexity: Payment terms, quick pay discounts, and mixed-period deductions make cash vs. accrual reconciliation extremely difficult

- No product-level visibility: Amazon provides no native tools to analyze unit economics or product profitability

These challenges lead sales leaders to deprioritize their own profitability in favor of easy-to-manage metrics like Net PPM. Not only does this sacrifice the brand's structural profitability for Amazon's, it limits the brand's ability to optimize catalog, advertising, pricing, and product development strategy.

Managing Amazon's P&L Complexity

As former vendor managers, we dealt with Amazon systems personally and built BASIS to automate these challenges away.

Data Fragmentation

Amazon scatters P&L data across dozens of disconnected systems. See what matters and how to bring it together.

Learn moreTiming Complexity

Payment terms, PFR, and mixed-period deductions make cash vs. accrual reconciliation a headache without automation.

Learn moreProduct-Level Economics

There's no Seller SKU Economics report for Vendors. Learn how to model ASIN-level profit anyway.

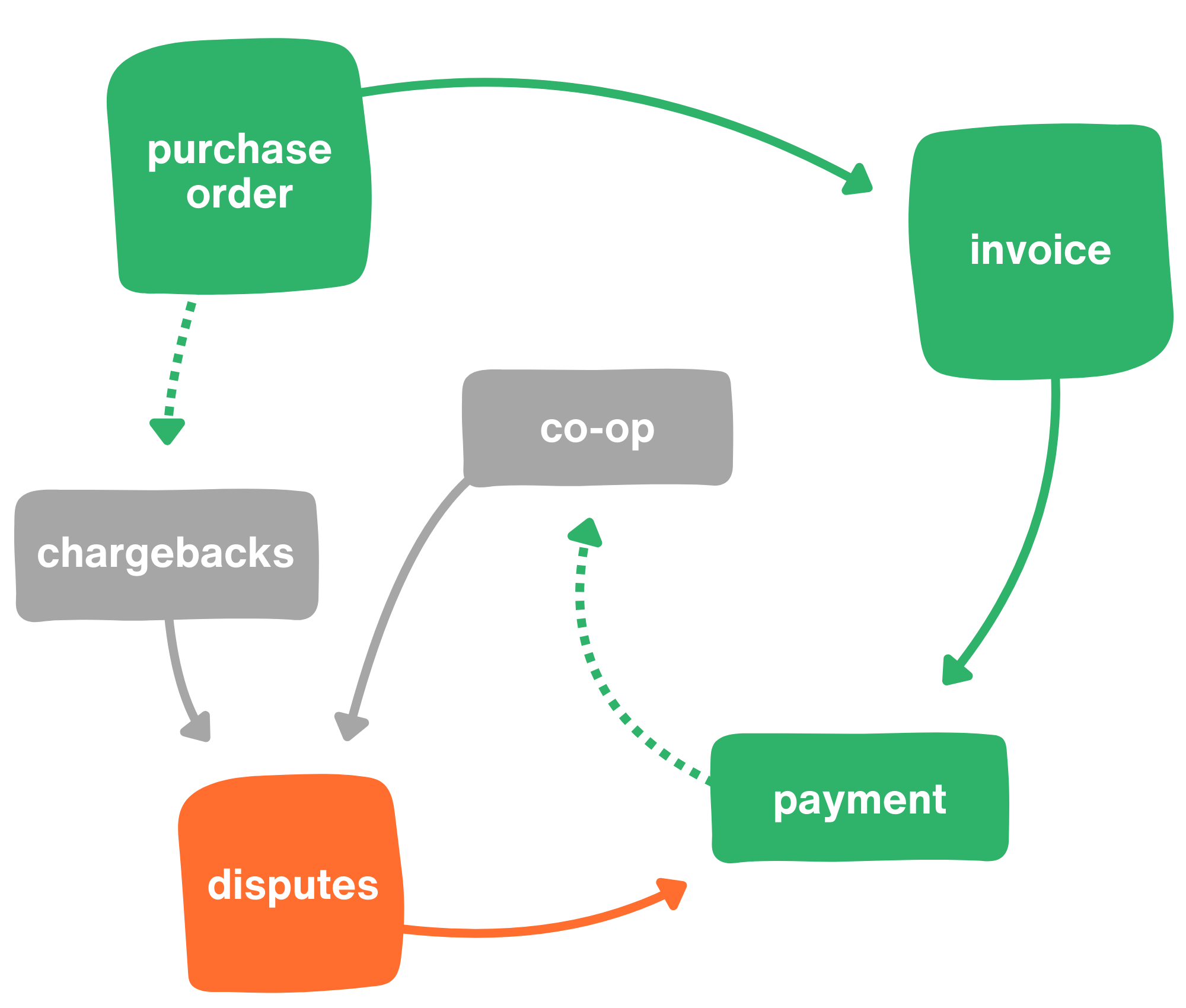

Learn moreThe Data Fragmentation Problem

Finance teams spend days preparing data before they even begin analysis

Vendor financial data is a time-consume challenge to assemble because it lives in multiple different systems. It takes a combination of purchase orders, invoice records, remittance details, advertising expenses, and more to create an accurate P&L picture.

For added complexity, the data isn't ready to combine and analyze straight out of Vendor Central, EDI, or Amazon's APIs. More challenges are ahead:

- Granularity: Each data source contains a different level of detail: one might contain summaries and another might contain detailed line items. This makes joining the data together a challenge.

- Missing keys: To connect two data sources, they need to have the same identifying information, like PO number or Invoice number. But they rarely do. Analysts must therefore find or create bridges in other data sources.

- Coding: Amazon data isn't formatted for ERP ingestion or accounting work. It takes thoughtful, consistent categorization to properly ledgerize the data for accounting use.

20-30 Hours Per Month

Finance teams at mid-sized vendors spend this much time getting data from dozens of reports in Vendor Central or Amazon APIs, then overcoming these challenges manually with tools like Excel and Python just to close the books.

Purchase Orders

PO numbers, quantities, prices, and fill rates live in their own system, apart from finance

Invoice Records

Your submitted invoices as received by Amazon, with summary and details stored separately

Remittance Details

Amazon's payments to you with coop and claim deductions itemized, but from multiple periods

Advertising Expenses

Most Sponsored Advertising and DSP costs are invoiced separately from retail vendor costs.

The Timing Complexity Challenge

When payments from one period include deductions from another

Cash vs. Accrual Accounting in Amazon's Payment Infrastructure

For traditional wholesale businesses, the gap between cash and accrual accounting is relatively straightforward to manage: you record revenue when you ship goods (accrual), and track the timing difference until payment arrives (cash). Amazon vendors face an exponentially more complex version of this challenge due to Amazon's unique payment terms, deduction practices, and multi-period reconciliation requirements.

The fundamental problem is that Amazon's remittance checks don't map cleanly to any single accounting period. A payment received today might include amounts from invoices submitted 60-90 days ago, minus deductions related to agreements made in different quarters, plus dispute reversals from chargebacks filed months earlier. This temporal complexity makes it nearly impossible to accurately recognize revenue, calculate COGS, or assess profitability for a given month without sophisticated reconciliation infrastructure.

Payment Terms & Quick Pay Discounts

Amazon's standard payment terms for vendors typically range from Net 60 to Net 90, meaning invoices are paid 60-90 days after Amazon's receipt of goods. This creates immediate timing complexity: your January shipments might not generate cash until March or April, making cash flow forecasting difficult and creating a constant multi-month gap between recognized revenue (when you ship) and cash collection (when Amazon pays).

Many vendors participate in Amazon's Quick Pay program to accelerate cash flow. Quick Pay offers immediate payment in exchange for a discount (typically 2-3% of invoice value). While this solves the cash timing problem, it creates accounting complexity: the quick pay discount is effectively a financing cost that must be properly categorized.

Coop & Deduction Timing Mismatches

The complexity compounds significantly when Amazon deducts coop, marketing development funds (MDF), or operational chargebacks from your payments. Because of Amazon's payment terms, the deductions taken from a given payment often relate to invoices from completely different time periods than the invoices being paid in that same check.

Consider a remittance received on March 15th with Net 60 terms. This payment includes amounts for invoices from mid-January (60 days prior). However, the coop deductions taken from that same March 15th payment might relate to promotional agreements signed in December, marketing campaigns run in February, or even chargebacks from compliance violations that occurred in November.

Provision for Receivables (PFR) Deductions

Perhaps the most complex timing challenge faced by many vendors is the Provision for Receivables (PFR) mechanism. PFR is Amazon's system for withholding invoice payments when the money you owe Amazon for deductions (contra-COGS, shortage claims, chargebacks, etc.) exceeds the money they owe you for purchase orders in a given period. This is driven by (1) the difference between Amazon's payment terms with the brand (often Net 60-90) and the brand's payment terms with Amazon (often due on receipt) and (2) the periodic nature of operational deductions like shortage claims and reimbursements.

PFRs make reconciliation even more difficult by adding another type of line item to audit and further breaking pattern recognition because Amazon's deductions will match your invoiced amounts even less often. They make cash flow even less predictable.

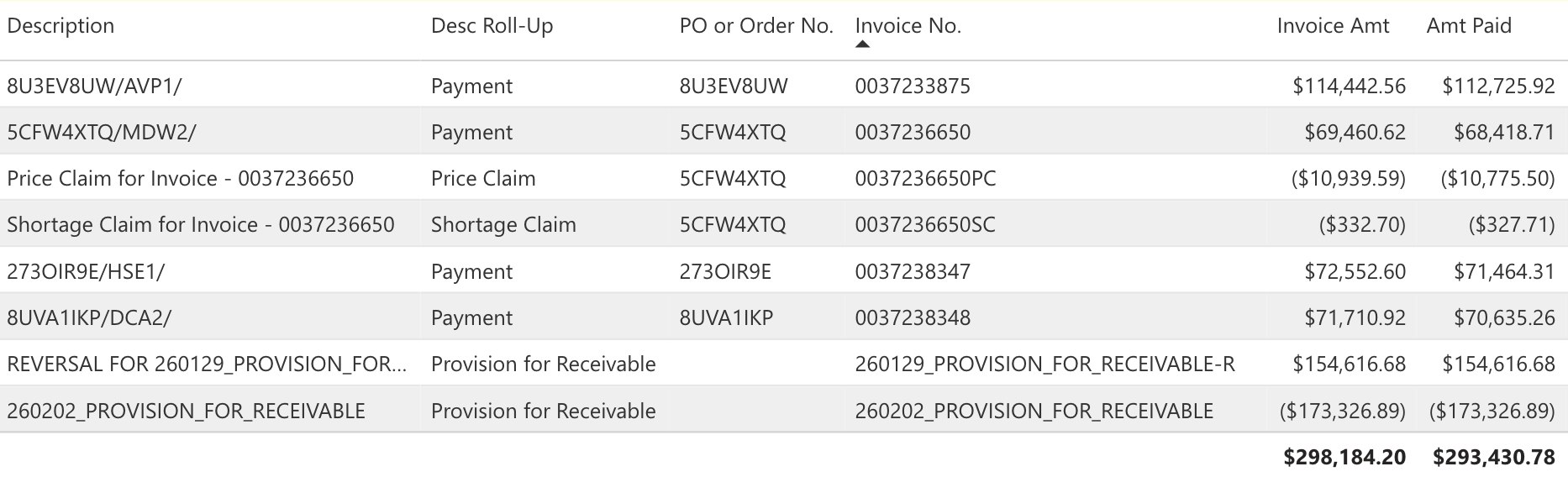

Example Vendor Payment from Amazon

Amazon doesn't issue one check per invoice. Instead, each payment from Amazon aggregates all cash activity due at the same time. While efficient for Amazon, payment aggregation makes reconcilation 10x harder for accounts receivable because the value of the check does not correspond to any value in the brand's system. Instead, accounting must decode the invoice line items and manually reconcile invoices across multiple payments and periods. PFRs further complicate by adding another level of opacity requiring separate investigation.

Multi-Period Reconciliation Requirements

The cumulative effect of payment terms, quick pay discounts, mixed-period deductions, and PFR is that closing your books for any given month requires reconciling transactions across 2-6 prior months. This is why most Amazon vendors operate with 30-90 day lags in their financial reporting. By the time you've assembled all the data needed to accurately close February's books, it's already April—making it nearly impossible to make timely business decisions based on true profitability metrics.

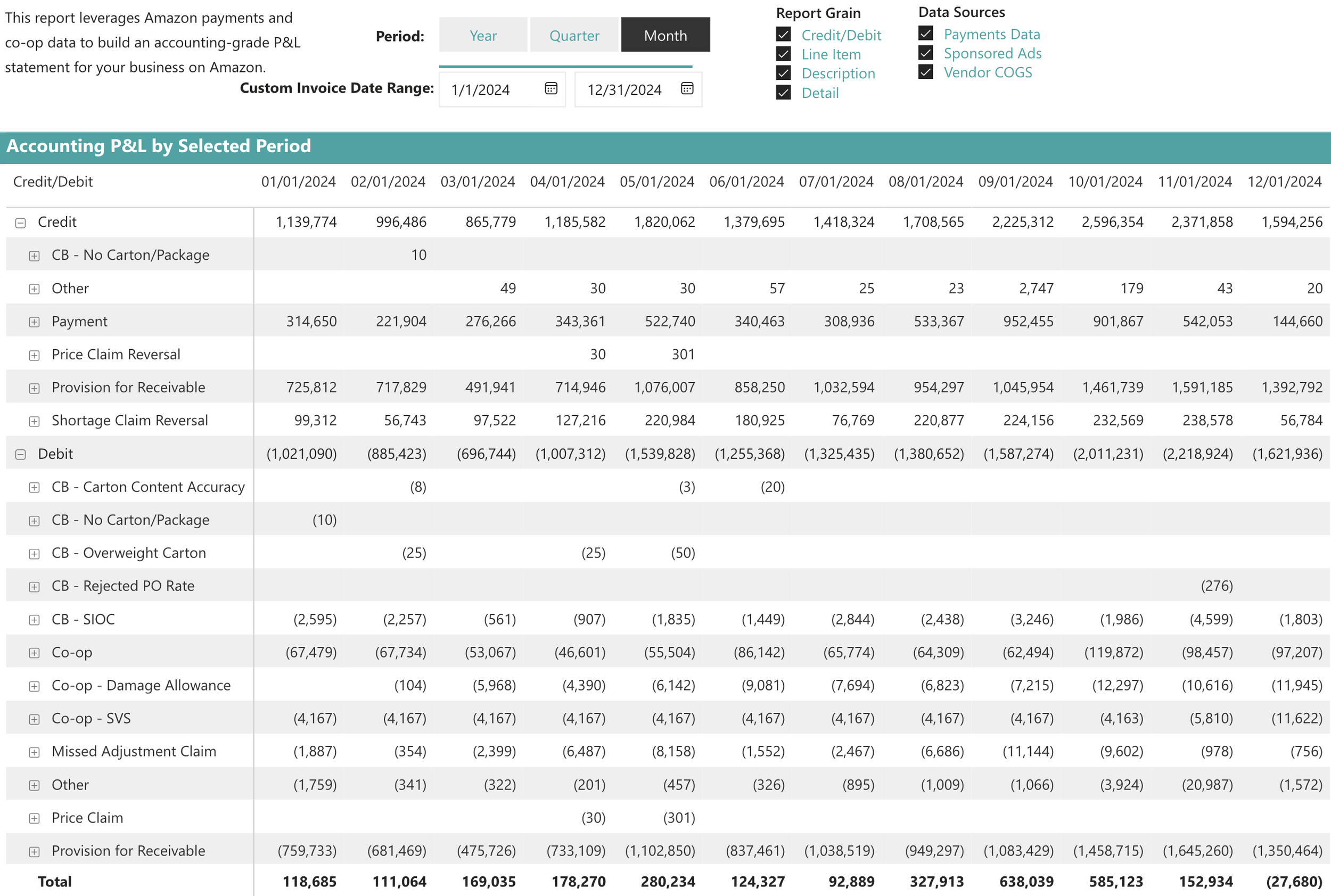

Automated Financial Models for 1P Brands

Turnkey Vendor P&L Interface: BASIS automatically connects every financial event across Amazon's fragmented systems, then presents everything in P&L and audit views that your finance team is used to. No more manual downloads or weeks in Excel.

Automated Data Unification

All POs, invoices, remittances, deductions, and other expenses connected in a single data model

Intelligent Categorization

Deductions automatically classified by type, with easy access to supporting details

Accounting-grade accuracy

Our systems match Amazon financials to the penny, building trust with your stakeholders

Ready for AI

Eliminate AI data prep and annotation with BASIS semantic models, schemas, and documentation

The Product-Level Economics Puzzle

Understanding which products actually drive profitability

Understanding your overall Amazon P&L is difficult because of the data fragmentation and timing complexity challenges. Measuring the profitability of individual products is even harder. It's not enough to align, add up, and reconcile all billing activity for a period. The exercise is more complex at the product level:

- Amazon payment details have PO-level line items, not product-level. Bridging PO payments to product payments requires another level of analysis.

- The payment for a product, deductions for accruals, payments for advertising, and promotional expenses can all occur in different periods.

- There is no interface in Vendor Central to begin examining product-level expenses or profitability, beyond Net PPM.

- Operational issues like shortage claims and chargebacks are usually driven by a subset of selection, making product-level attribution especially critical.

Product-level Profit Impacts Your Entire Business

Portfolio Optimization

"Which of my 500 SKUs should I focus on growing, and which should I discontinue?"

Advertising ROI

"Is my advertising spend on ASIN X actually profitable, or just revenue-driving?"

Pricing Strategy

"Can I afford to lower prices 10% on my hero product to compete better?"

Margin Trends

"Why is overall profitability declining—is it Amazon deductions, rising COGS, or mix shift?"

New Product Decisions

"We want to launch a new product, how profitable were similar products in our catalog?"

Operational Efficiency

"Which products generate the most unresolvable chargebacks or compliance issues?"

Vendor Unit Economics Built for Serious Amazon Teams

ASIN P&L Dashboard: See the complete economics of every product in your catalog. BASIS automatically combines shipped COGS, Amazon contra-COGS deductions, advertising spend, operational fees, penalties, refunds and reimbursements, and even an optional product cost upload into a single product-level P&L data model. Use our taxonomy system to analyze performance by category, brand, or any custom grouping—and identify your true profit drivers.

Automated Data Integration

All financial, operational, and advertising data automatically linked at the ASIN/SKU level in our data models

Contra-COGS Attribution

Accruals, chargebacks, and fees precisely allocated to products using your actual receipts, not just agreement terms

🎯 Taxonomy-Powered Analysis

BASIS's custom taxonomy system lets you organize products however makes sense for your business. Create categories like "Premium Line," "Value SKUs," "New Products (2024)," or "High ACOS Items"—then instantly view P&L metrics aggregated to those groups. Analyze performance by category, compare subcategories, or drill down to individual SKUs, all without rebuilding your data model.

Tired of manual downloads? Try BASIS for Free.

Fully-functional interactive demo with mock data. No phone number or sales call required.