Sellers May Be Paying Because Amazon Bought Too Much Warehouse Space: Report

Merchants are paying the price for Amazon’s decision to purchase too much warehouse space, according to a report.

Wired reports that shortly after Amazon announced it had built or bought $2 billion too much warehouse space, third-party sellers were informed that their Fulfillment By Amazon (FBA) fees would rise 4.3% due to a "fuel and inflation surcharge."

FBA is an attractive option for sellers because they can store their products in Amazon fulfillment centers and let the retail giant take care of all the logistics of packing and shipping their products to customers (not to mention they benefit from the fast delivery speeds for Amazon Prime customers).

But Amazon continuing to transform itself into a logistics powerhouse means acquiring more warehouses to better spread the company across the world, which in turn raises costs, the report stated. While Amazon takes away the logistics headaches, it cuts into the bottom line of sellers, and the fuel surcharge makes profit margins that much thinner.

However, the report noted that an Amazon spokesperson denied that there was any connection between rising fees and the additional warehouse space Amazon has acquired. Instead, the spokesperson blamed inflation.

Amazon may be looking to lease out some of this excess warehouse space, according to a Bloomberg report. The company wants to sublet at least 10 million square feet of space that it overbuilt due to the pandemic shopping boom, and they may also look to end leases with landlords to deal with the issue.

Sellers who are frustrated with rising fees may find it difficult to get rid of Amazon and go it alone. For one thing, many have built their entire operations off of FBA services. And for another, warehouse vacancy rates are extremely low, making it tough to find space at prices that make it worth it to leave Amazon.

For sellers who are exploring alternative warehousing and shipping options to save money, it's important to understand where you stand now. You should closely examine certain reports within Amazon Seller Central in order to have a clear idea of your business’s needs. Here are the reports to pay closest attention to, as described in our Seller Central Help Center (click each report for more information on how to understand them):

Inventory age (FBA) — A snapshot of what inventory is currently at Amazon's warehouses broken out by the age of said inventory (duration it's been at Amazon).

Manage FBA Inventory — ASIN information by listing, condition, disposition, and quantity for items in Amazon's fulfillment network.

Inventory All Listings — A catalog of all of a seller's listings, which includes attributes, item name, item description, data on when an ASIN was opened, and snapshot data on MFN inventory levels.

Received inventory — Shows movements on inbound shipments as Amazon is receiving and transferring inventory within their network.

Restock inventory — Shows inventory (at the ASIN level) that can be shipped into Amazon as well as a snapshot of inventory in Amazon's fulfillment network.

Reserved Inventory — The status of inventory that is being processed for customer orders, transfers between fulfillment centers or have been sidelined for various reasons at an Amazon fulfillment center.

Daily Inventory History by FC — Shows daily inventory in Amazon's fulfillment centers including quantity, location, and disposition.

Monthly Storage Fees — A detailed breakdown of how your storage fees are calculated by ASIN.

Shipping Queue: Summary — Shows all FBA shipments you are working on and those that have been sent to Amazon.

Shipping Queue: Contents — Provides details on all FBA shipments you are working on and those that have been sent to Amazon.

Once you use these reports to create a complete picture of how much you're spending on warehousing and shipping with Amazon, it will be easier to create more accurate estimates on what you might save (or not save) by doing it yourself or going with a third party.

For more information on how to compile this data more efficiently without having to spend hours manually downloading reports and combining them, download our free whitepaper below on data extraction methods.

READ MORE:

Turn Amazon Data into a strategic Asset

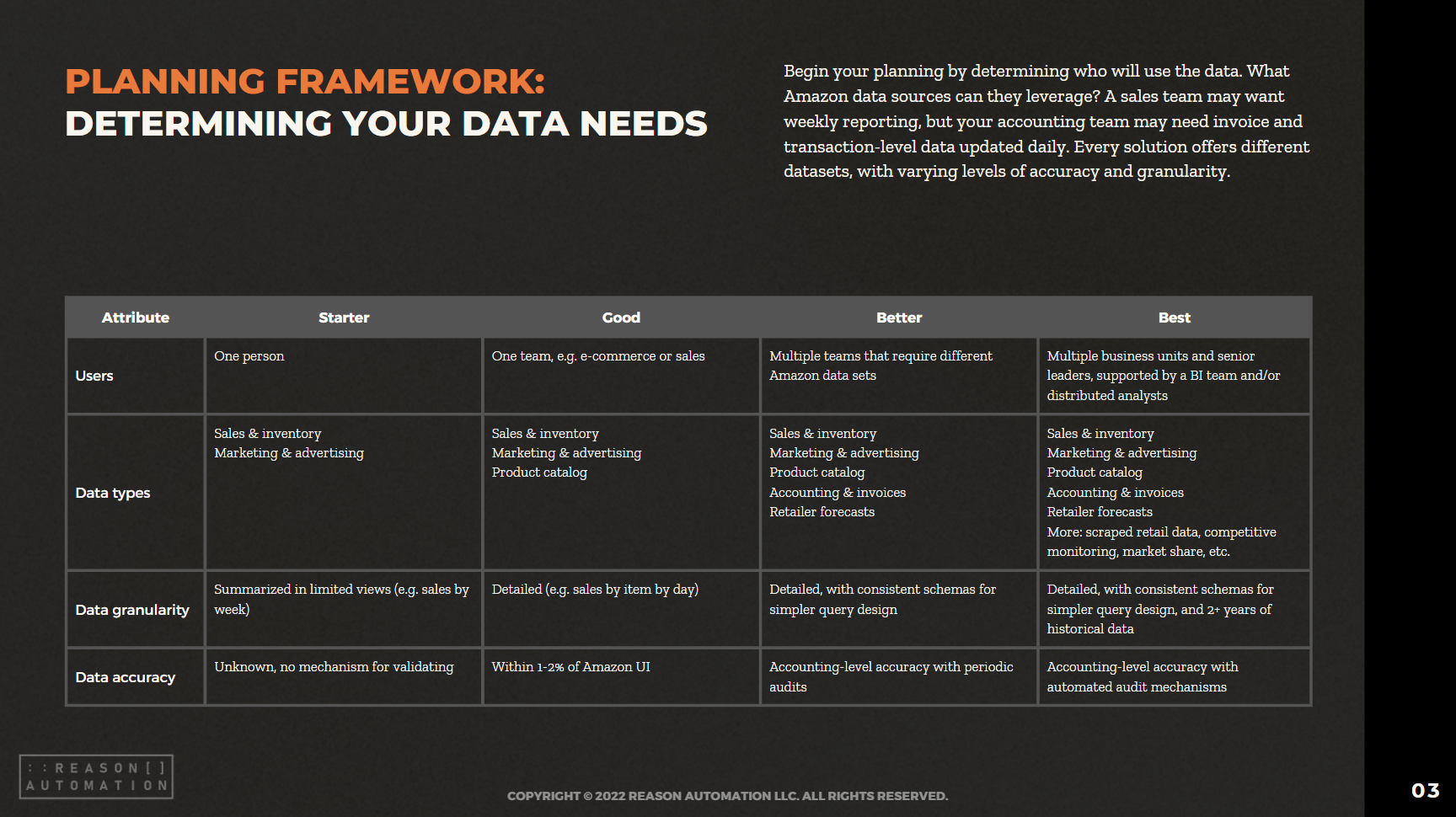

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.