Amazon Raises FBA Fees for Selling to Canada, Mexico

Amazon sellers who fulfill orders to customers in Canada and Mexico will have to pay extra FBA fees starting June 30, 2022.

Amazon has announced "Remote Fulfillment with FBA," a different service from FBA Export that applies only to sellers who deal with the two U.S. neighbors. Amazon will increase FBA rates and also add a dimensional weight adjustment in rate calculations. Here is a full comparison chart of rates before and after June 30 for both Canada and Mexico.

"We’ve nearly doubled fulfillment capacity and added over 750,000 full- and part-time roles, and our average hourly wage in the US has climbed from $15 to $18," Amazon wrote in a post in the Amazon Seller Forums justifying the rate increases. "These investments have enabled tremendous growth for sellers, who have increased sales in our store by more than 70% during this time.”

Amazon says that in order to be eligible for Remote Fulfillment, you must be "a professional seller registered for FBA in the US and the destination stores that you want to sell in, and have a North America Unified Account with FBA Export enabled," Amazon said in an announcement on Seller Central. Eligible sellers for Remote Fulfillment in Canada or Mexico or both will be automatically enrolled beginning on July 1.

"Since 2018, businesses that participate in FBA in the US have been able to use Remote Fulfillment with FBA to make their US inventory available for sale in Canada and Mexico," Amazon said in its forum post. "This program offers customers increased selection and gives you the opportunity to sell easily outside of the US.”

"Remote Fulfillment with FBA leverages both US and international fulfillment operations," the company added. "Over the course of the pandemic, we have made significant investments in these operations to better serve you and our customers."

This appears to be the latest in a series of moves by Amazon to offset costs in the wake of nationwide inflation. Also this year, Amazon announced a 4.3% increase in FBA fees to offset fuel and inflation costs, although some argue that it may be more to do with the company investing in too much warehouse space.

READ MORE:

Turn Amazon Data into a strategic Asset

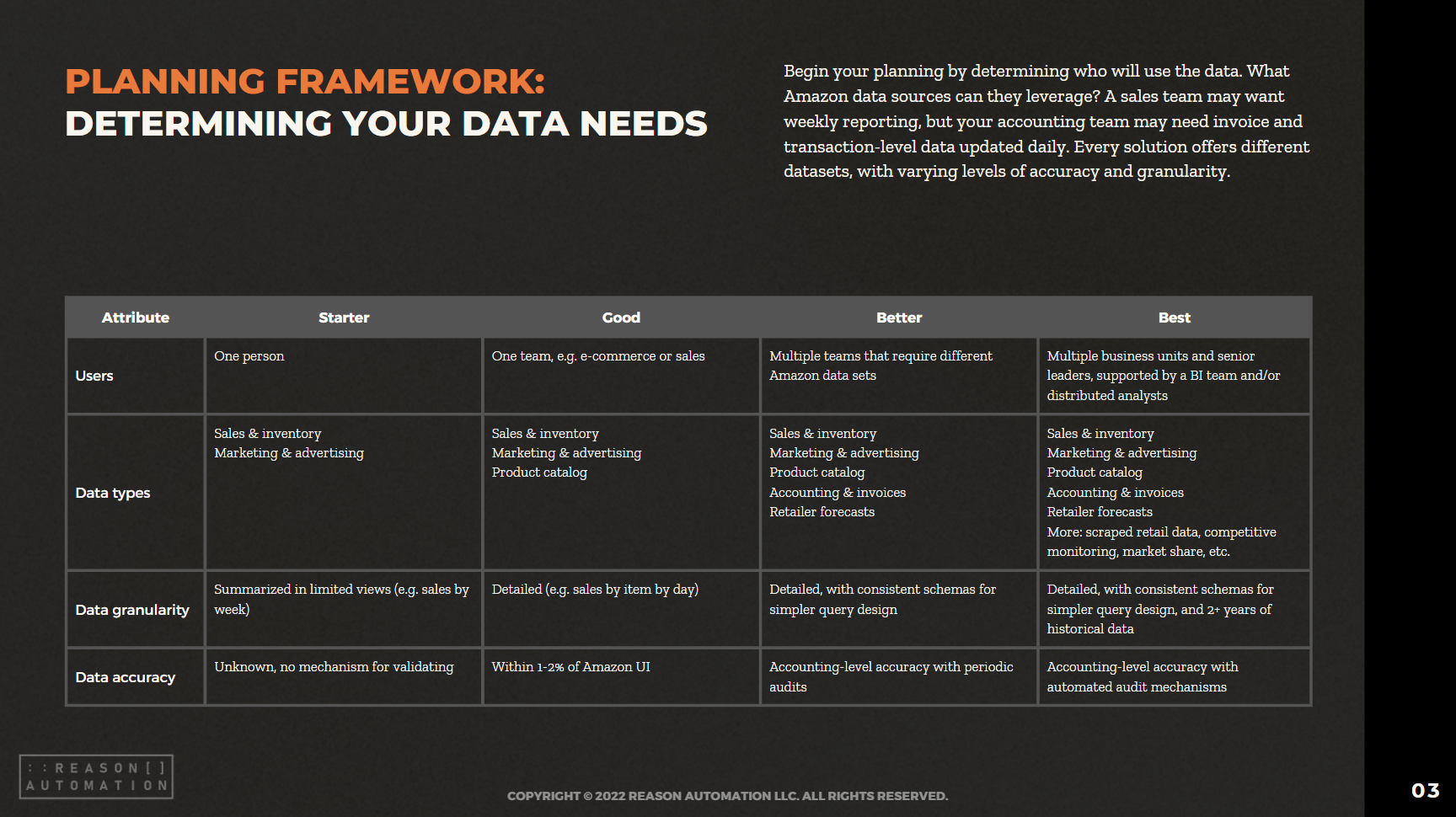

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.