Resources & Documentation

Comprehensive guides, documentation, and strategic resources to help you maximize your use of the Reason platform and your Amazon business performance.

Amazon Vendor Strategy

Strategic guides for vendor operations and growth

References by Category

Comprehensive help documentation by platform

Database Connection Guides

Connect your favorite BI tools to your data

User Manuals

Step-by-step guides for Reason tools

Data Dictionaries

Complete reference for all data fields

The Net PPM Formula & Why Amazon Vendors Must Track This Metric

Vendors should think about Amazon’s profitability regularly — not just when QBR and AVN approach.

Amazon Demand Forecasting for Vendors

Amazon provides a consumer demand forecast for vendors in Retail Analytics. It’s the only leading indicator of what Amazon will buy from you, but most people dismiss it. Why?

Measuring Lost Buy Box and lost featured offer % as a 1P vendor

For ecommerce companies who sell through Amazon, the buy box is the difference between good and bad sales figures for a product. So here’s what you need to know about losing the buy box, and what you can do about it.

Amazon Glance Views and featured offer page views: About Vendor Central Traffic & Conversion Data

Your comprehensive guide to Amazon Vendor traffic data and analytics.

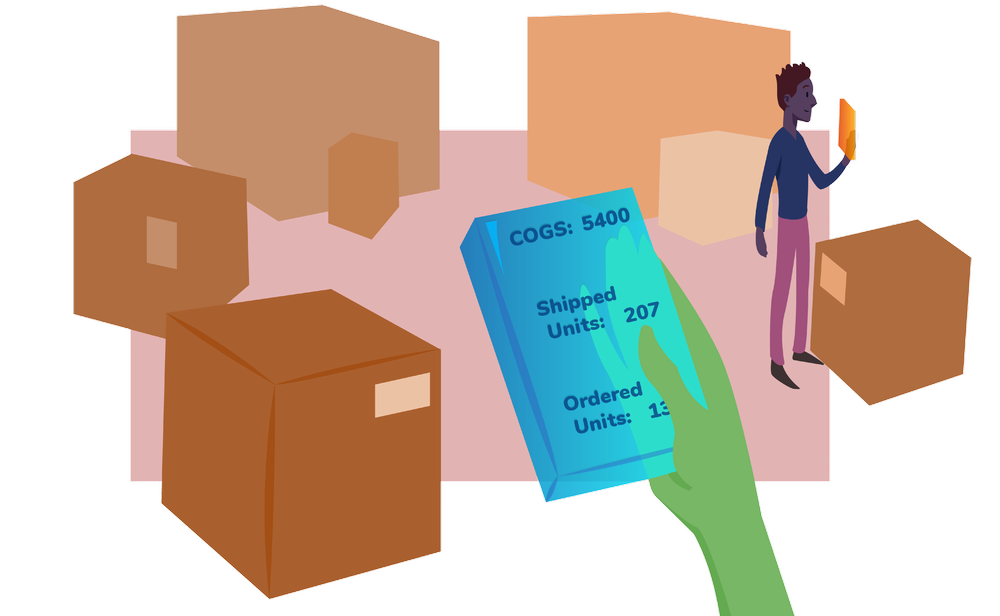

How to Understand and Use Amazon Vendor Central Reports

Understanding Amazon Vendor datasets and performing specific analyses is crucial for vendors to optimize operations, improve customer satisfaction, and drive success on the platform.

Top 5 Free Amazon Seller Analytics Tools

Being an Amazon seller means constantly crunching numbers. But dealing with data can be expensive, so you’re always looking for some free tools that can make your life a little easier.

Why Our Customers Own Their Data

Everyone loves useful insights and benchmarks. They give us ideas, help us understand whether we're performing better or worse than average. But insights aren't free—they cost the privacy of everyone who contributed data, even anonymous data.

Why We Started Reason Automation

When pulling data takes time, you do it less often—and anyone managing an Amazon business knows that speed and frequency matter. If ad performance fluctuates daily, can you afford to look at your business data weekly or monthly?