American Amazon Sellers Increasing, Chinese Sellers Decreasing: Report

Changes both within Amazon and in the global economy may be causing a geographic shift among Amazon sellers, with a growing number of American sellers and a declining number of Chinese sellers, according to a recent report.

At one point, Chinese sellers made up half of the top brands on Amazon, but that number has fallen to 38% since last September, states a report from Marketplace Pulse.

The report found that 55% of the top third-party sellers in the United States are domestic businesses, a significant increase from November 2020 when that number was just 48%.

The report claims that this is due to a combination of pandemic lockdowns, supply chain issues, seller suspensions, and Amazon FBA inventory limits. Also, new seller registrations from China have been declining.

"There has also been a decrease in new seller registrations from China, while they only recently represented 75% of all new sellers," the report states. "Finally, Chinese sellers are also losing market share in the U.K., Germany, Japan, and Amazon’s other marketplaces.

"It’s unclear what else is influencing the trend and, crucially, whether it won’t get re-reversed," it continues. "Before 2020, the future of the Amazon marketplace seemed to have little space left for domestic sellers. Every year, their portion of the market decreased. For now, some of that has been undone."

A report from ModernRetail suggests that Amazon cracking down on fake reviews in recent years may be helping fuel the shift. And rising costs have taken away some of the advantages that Chinese sellers have enjoyed.

However, it's possible that the footprint of Chinese sellers is obscured by the fact that many of them are setting up LLCs in the United States, meaning that many of them are counted as American companies. The ModernRetail report pointed to Anker, a top seller of electronics that is listed on the Chinese stock market but has an address in California.

READ MORE:

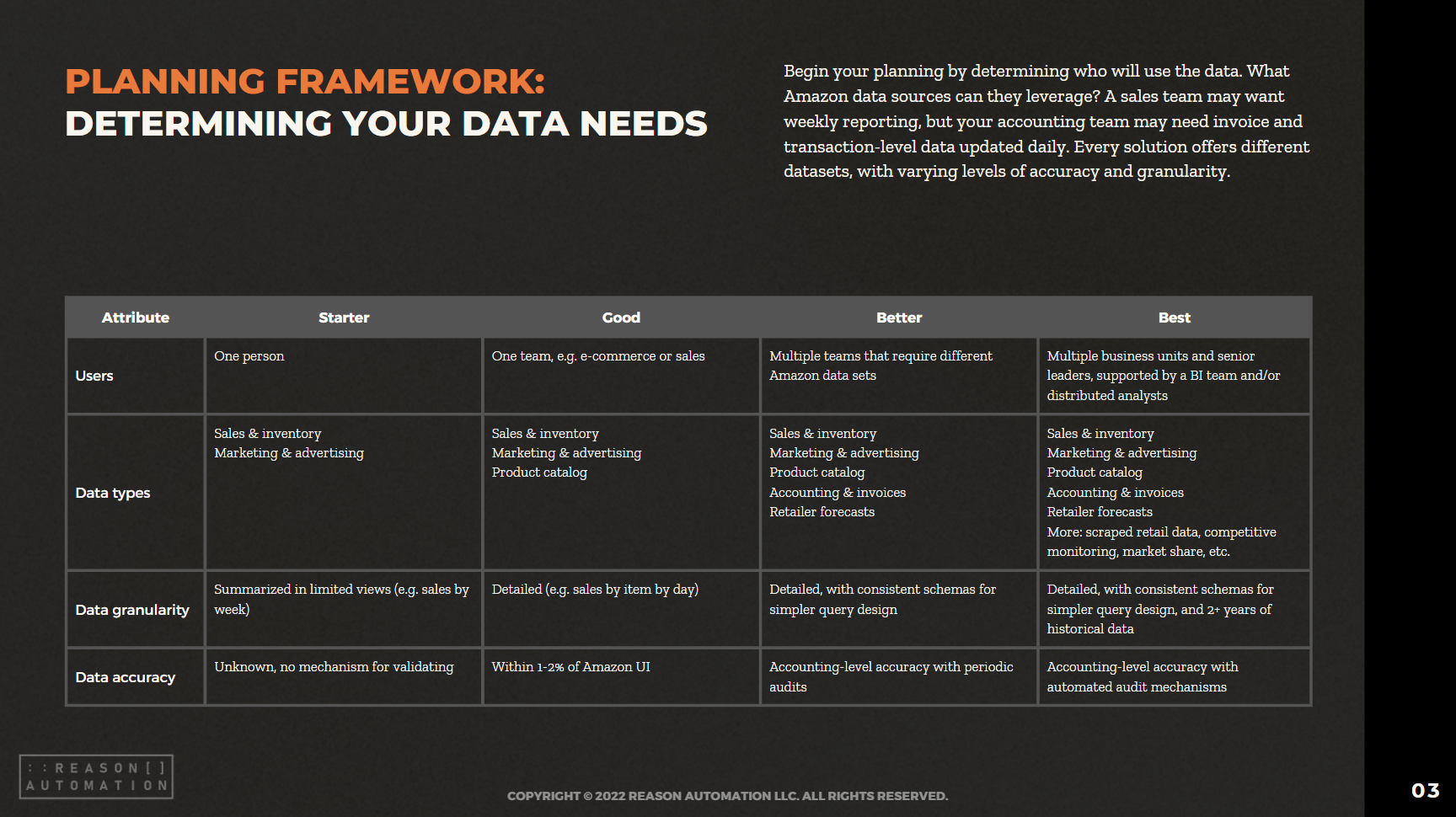

Turn Amazon Data into a strategic Asset

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.