Amazon Accrual Agreements: How They Work and Why You’re Seeing Deductions

Amazon vendors must always keep an eye on their costs in order to keep profit levels where they need to be, so if you’re a vendor who has noticed deductions, you might be wondering what is going on and what the reason is.

This guide breaks down what accrual agreements are, what kind of deductions you might see, and what you can do to lower these deductions.

What Are Amazon Accrual Agreements?

Amazon accrual agreements are agreements that allow the retailer to push operating, logistics, and marketing expenses to the vendor -- lowering Amazon's overall costs and increasing their profits in the process.

Accrual agreements fall under the larger category of coop agreements, and they specifically include things like freight allowances, damage allowance, and MDF agreements where both Amazon and the vendor share costs. Amazon deducts directly from the vendor with accrual agreements based on predetermined terms.

Why Is Amazon Making Deductions to Your Account?

It’s not uncommon for Amazon vendors to see that Amazon is making deductions to their accounts and wonder what is going on. The answer is probably found in your accrual agreements. When you sign up to be a vendor on Amazon, you sign certain coop agreements with Amazon that allow the company to deduct funds from your account to help cover some shared expenses, such as marketing and shipping costs.

To understand what is happening, you need to understand what your accrual agreements say. When Amazon makes a deduction, they may reference the type of agreement that it falls under. You can then pull up the relevant accrual agreement to determine why Amazon is making the deduction, and either adjust your budget accordingly or focus on negotiating a better agreement with Amazon (or both).

Common Accrual Fees for Vendors

Three of the most common fees you will see are MDF fees, damage allowance fees, freight allowance fees.

Market Development Fund (MDF) Fees

Your MDF agreement covers the fees you pay Amazon for marketing, which can include everything from Amazon search algorithms to personalization widgets like "customers who bought x also bought y." Amazon may invest this money into anything relating to customer service and driving sales. A typical MDF fee is usually around 10%, but this can vary depending on the vendor.

Further reading: MDF CoOp Agreement: Amazon Vendor Tutorial

Damage Allowance Fee

This is a fee ranging from 2-5% to cover the cost of handling the return and disposal of damaged items. You can avoid this fee altogether by choosing to take care of these costs yourself, although that may prove to be more expensive.

Further reading: Damage Allowance Amazon CoOp Agreement: What Vendors Should Know

Freight Allowance Fee

Also about 2-5%, the freight allowance fee covers shipping your products from your warehouse to Amazon's warehouses so they can then move it along to customers. You can go with prepaid or collect freight terms.

Further reading: Amazon Freight Allowance: How to Get the Best Terms

Accrual Agreement Payment Methods

The actual payment arrangements for accrual agreements vary based on two main factors: whether it is done by net receipts, or by shipped COGS.

Net Receipts

In this case, your deductions are based on total Net Receipts – or everything you send to Amazon. So if you send $100,000 worth of product and there is a 10% accrual on Net Receipts, Amazon will take $10,000.

Shipped COGS

If your accrual agreement deals with Shipped COGS rather than Net Receipts, the deduction will look different. In this case, if you send $100,000 worth of product, and Amazon only sells $50,000 of it, Amazon is entitled to deduct only from the Shipped COGS – so it would be a $5,000 fee, rather than $10,000 for Net Receipts which takes into account all product sent do Amazon regardless of whether it was sold.

Don’t Like Your Accrual Agreements? There may be Ways to Improve Them

If you’re not happy with the terms of your accrual agreements, you’re not alone. Many vendors initially get locked into accrual agreements that don’t work for them. But the good news is that it may be possible to get better terms on some agreements through negotiations with Amazon. The following articles will help you understand how negotiations work and what you can do to improve your accrual agreements and coop agreements in general.

Read more:

READ MORE:

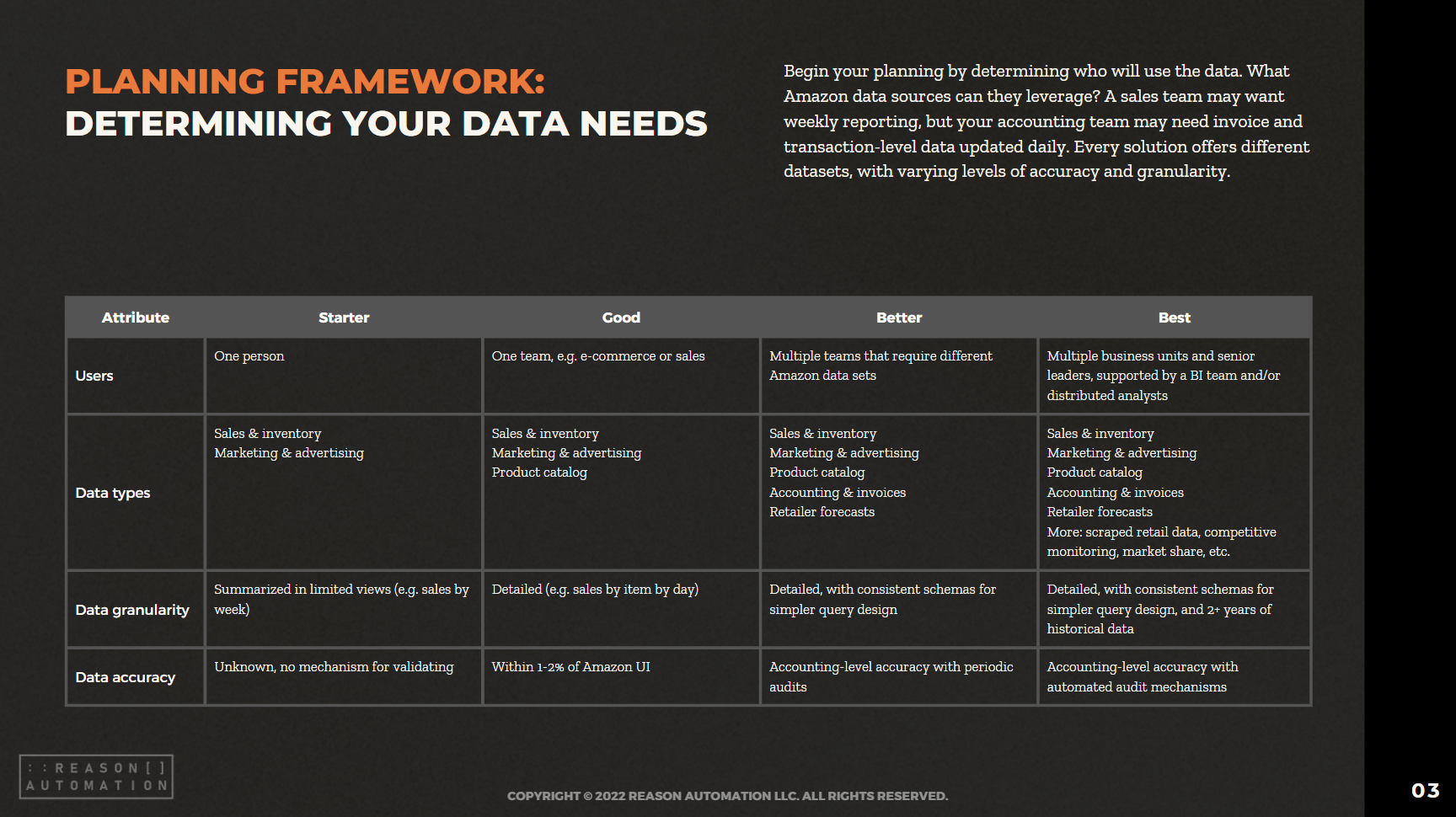

Turn Amazon Data into a strategic Asset

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.