Half of Amazon Sellers Unhappy About Recent Fee Hikes, Exploring Other Platforms: Report

A new survey suggests that Amazon sellers are increasingly unhappy about Amazon fee hikes and many are looking at selling on other platforms as a result.

The survey, published by Gartner subsidiary Capterra, found that:

48% of small retailers selling via Fulfillment By Amazon (FBA) say the holiday peak fulfillment fee will make them less profitable

54% of FBA users will raise prices as a result of fees

31% of FBA users currently list products on other marketplaces, but 99% say they will do so in 2023

50% of FBA users believe the fees are unfair to small-business owners

"While fee hikes are nothing new for FBA users, especially since the beginning of the pandemic, small retailers may be approaching the end of their rope," Capterra states in their report.

Related articles:

Amazon to Raise Seller Fees for the 2022 Holiday Season: Report

Amazon Hits US Sellers With 5% Fuel and Inflation Surcharge: Reports

The fee hikes may be opening the door to potential Amazon competitors, such as Walmart, which has made a bid to draw sellers to its site to sell their wares.

Lower earners are likely to be hit the hardest by fee hikes. Higher earners are better equipped to absorb the fee hikes, and are more likely to sell products in brick-and-mortar stores or on their own websites, the report finds.

Newer sellers also may be more put off by the fee hikes, versus veterans who are more experienced with the ups and downs of policy changes and may have strategies in place to handle them, the report adds.

These developments could have significant impacts on consumers, the report found, noting that consumers who are already dealing with inflation will also find Amazon's costs passed down to them.

"Higher prices and fewer Prime-eligible holiday gifts could compromise Amazon’s image as a one-stop shop for low prices and convenient shipping," the report states.

READ MORE:

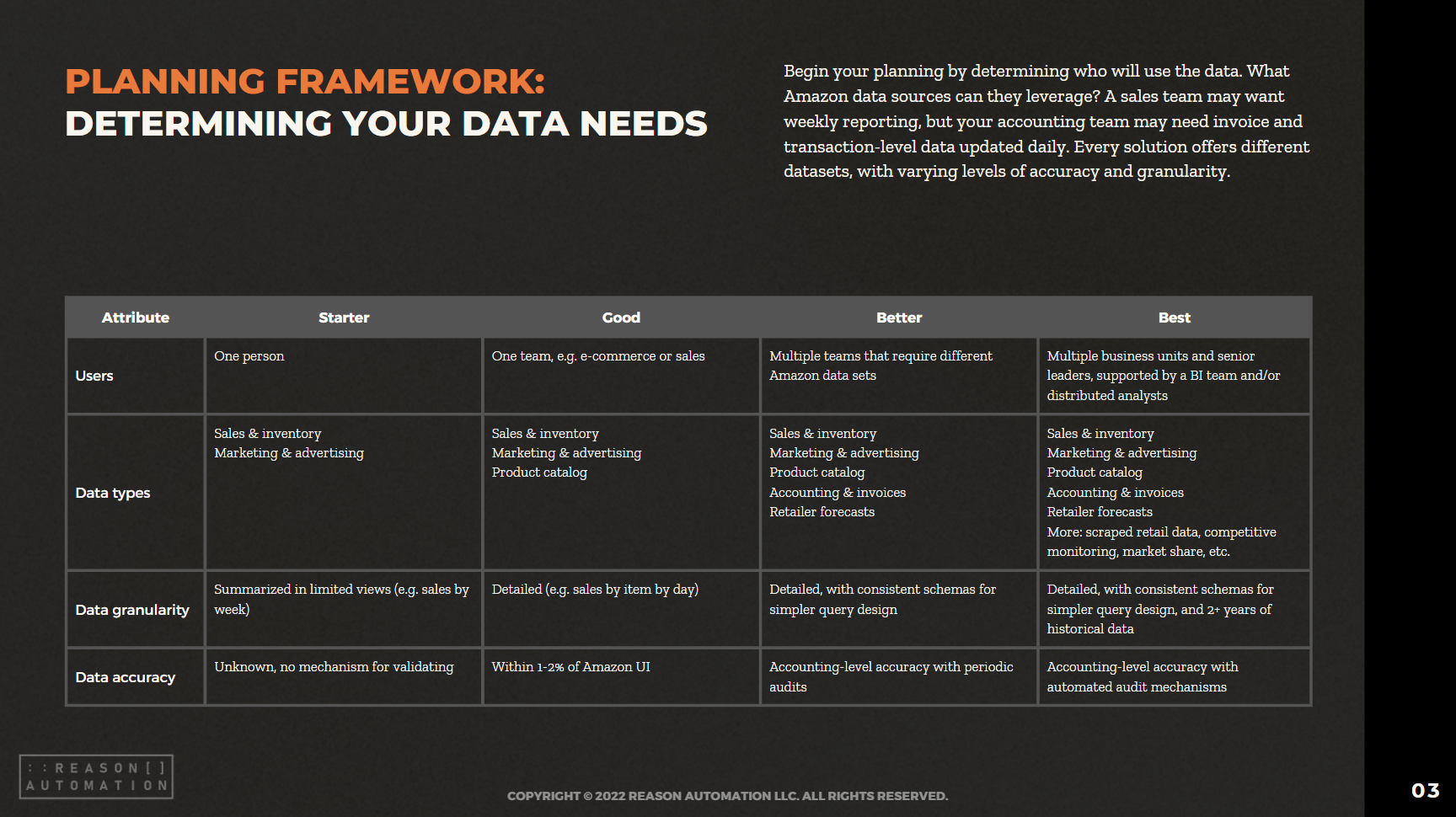

Turn Amazon Data into a strategic Asset

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.